With billions of tons of 43-101 iron ore located in their Quebec projects, Century Iron Mines has created an innovative corporate structure that will enable them to fund development and production efforts.

Getting a deposit out of the ground requires cash, and a lot of it. Recently, Metals News spoke with Sandy Chim, the President and CEO of Century Iron Mines, about his innovative strategy to keep Century Iron Mines iron ore projects in Quebec adequately funded.

Said Chim, “I started investing in iron ore about ten years ago in Canada. I was a shareholders in Consolidated Tungsten. That was my first iron ore project back in 2005. I got started in taking it all the way to a scoping study. At the same time, I invested in a number of other iron ore projects. From then, I kept investing and building the projects on geology. I took the company public last year. Because of the long term strength of the Chinese market, we attracted a lot of attention.”

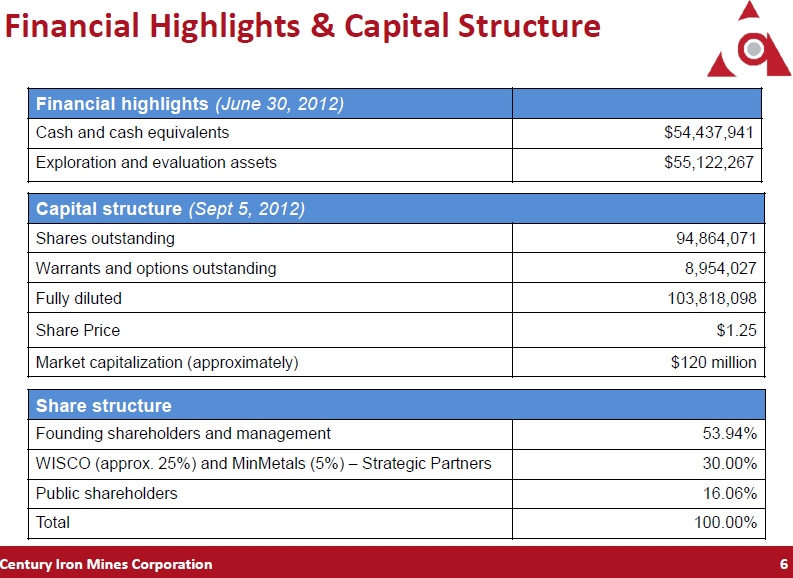

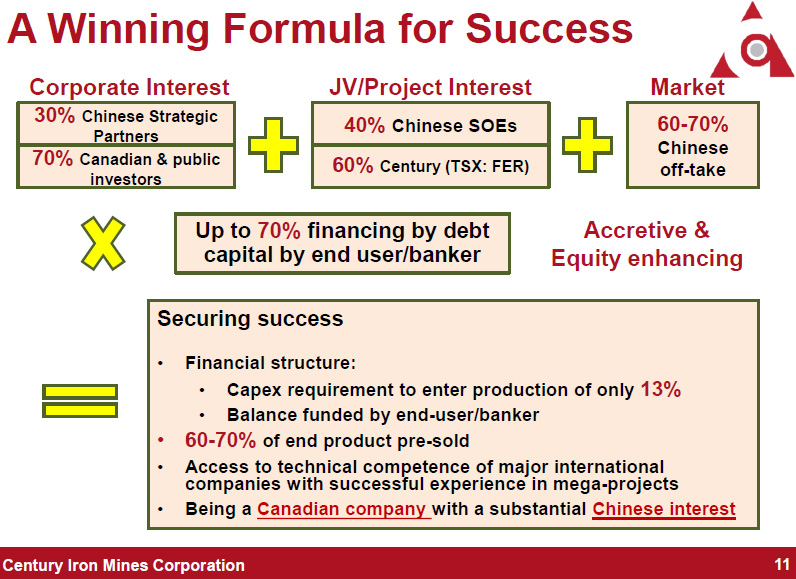

With that attention, Century Iron Mines used a diversified strategy to secure long term financing. Said Chim, “The company took 25% liquidity and signed a joint venture agreement with us to earn 40% of our project, up to $120 million dollars. This is how I have spent one hundred percent of my time and my energy over the last four or five years.” The focus of Century Mines is to learn from other company's past success. Chim said, “Our strategy is to learn from the success of Consolidated Tungsten. Iron is all about scale and scale is all about capital. It [Consolidated Tungsten] was pretty vulnerable when it didn't have the last $250 million dollars to complete the construction of Blue Lake. It became successful because it was able to get capital. We have structured Century to make sure that it has excess capital.” Shareholders are included in that capital funding. Said Chim, “Canadian public shareholders have 70% of that. At the joint venture level, they have 40%. The Chinese have about 60%. They participate in the growth of our project on the asset side as a shareholder and as a minority partner on the joint venture. Having this much interest by the Chinese gives us access to capital, because they would like to see the 60% grow.” WISCO has become a source of financial strength for the company. Said Chim, “Our strong capital structure through our joint venture with WISCO is to assume debt financing off from a future project. For example, if we need to raise $1 billion dollars for capital expenditure requirements, WISCO would help us to get a mortgage for up to 70%. We'd only need to raise $300,000. That is quite possible in this market. They have a majority economic interest and the Canadian shareholders have the controlling interest. They'd give us $160,000. We'd only need to raise $140,000. Capital is very important to work on our project.”

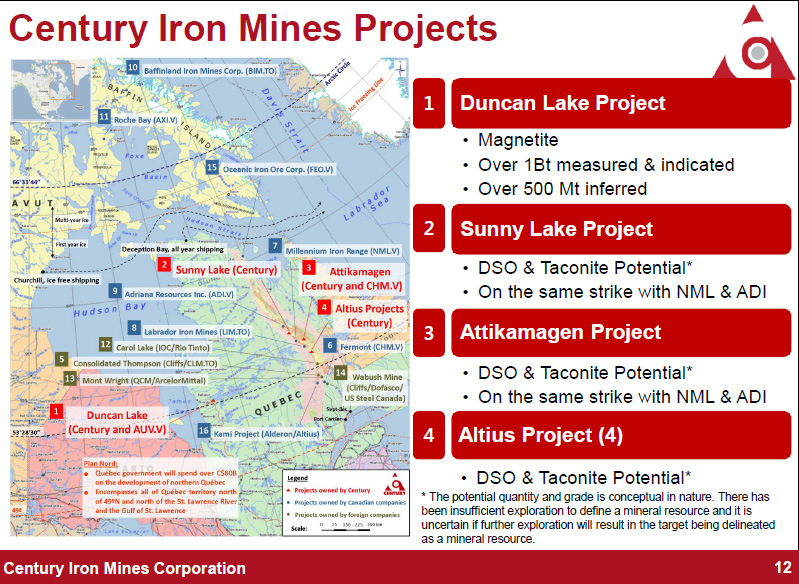

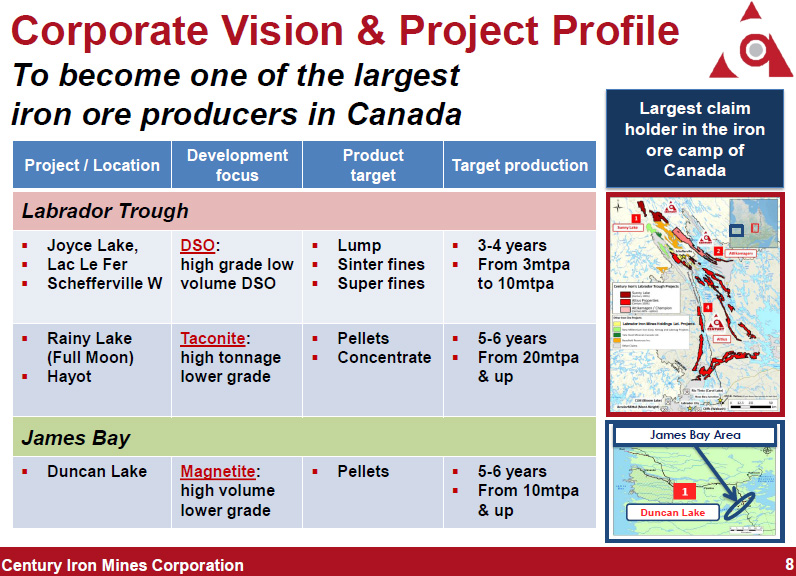

Century Iron Mines will need capital to get their three projects moving. Chim said, “We have in total company projects of 3.3 billion tons of 43-101 resources under management. That's huge, even by world standards, to have that amount of resources, and that's only a start. A couple of days ago, we announced 1.7 billion tons of new resource. We've got three relatively advanced projects. One is called Sunny Lake, of which we own 100%. Duncan Lake is in Quebec and has 1.6 billion tons of resource. At Sunny Lake, we just announced an exceptional resource we call Full Moon. It has some unusual thickness.” The third project is called the Attikamagen project. Chim couldn't be happier with the results to date. He said, “Three projects, so far two of the three have resources and we are evaluating the resources on Sunny Lake. This could be a billion ton project. We will finish our resource evaluation in a few weeks.”

Chim believes that there are reasons that investors might be interested in Century Iron Mines. He said, “The main reason for people to invest in our company is because we are very well positioned to bring our project to fruition. In bringing an iron ore project to fruition, capital is very important. If you go back five years and figure out which projects went from advanced stage to projection, you'd see why they go to production. For one reason or another, they couldn't develop a world-class resource. The incentive in the capital resource market is high for junior companies to find resources. Typically, junior capital companies have the efficiency to find the resource, but not the money to run it. With iron, to get to an economic scale, you need to have access to huge capital.”

Century Iron Mines has the capital to move from exploration to active production. Said Chim, “There is sufficient Chinese interest to see our project go forward. We have access to capital. An important factor is that we have access to markets. WISCO has signed an offtake agreement of 60-70% once we go into projection. They are a substantial investor. They have a large economic interest without control. Canadian public shareholders have the control.”

Understanding the complexities of the Century Iron Mines financial situation is key to attracting investors. Chim said, “These are the most interesting factors in explaining why investors might want to invest with us. We announced the results a few days ago and have gotten $20 million dollars wired into our account already from WISCO. From this point on, we don't need to use our treasury. That is one of the reasons that people might want to invest with us. We are still able to develop a project full force with $120 million dollars. We are targeting to produce in 2015. We have some resources in place. We have our first production project on a fast track. We are developing a bankable feasibility study and are expanding our resource, so we are very confident that we can do the environmental study and the logistic planning in order to come together by 2015. What is more important is that we have attracted a very important group of miners who have experience developing the last producing iron ore mine in Canada. That team was working with Blue Lake and now they have joined us.”

With access to capital resources and three projects well underway, Century Iron Mines is well positioned to move into production by 2015.

http://www.centuryiron.com/

170 University Avenue, Suite 602

Toronto, Ontario, Canada, M5J 3B3

Tel:+1(416) 977-3188

Fax: +1 (416) 977-8002

Investor Relations Contact

Bob Leshchyshen, MBA, CFA

Vice-President, Corporate Development & Investor Relations

Tel: +1 (416) 977-3188 ext 109

Email: bob.leshchyshen@centuryiron.com